Introduction

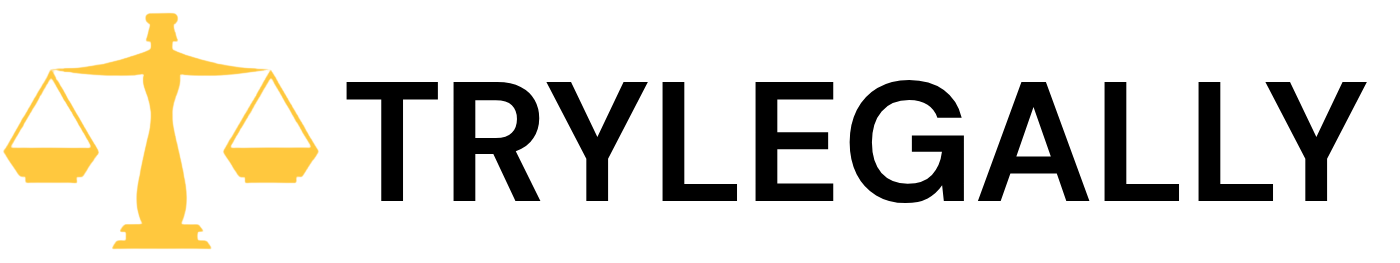

In the modern business landscape, the battle lines are no longer drawn solely by capital. The historical assumption—that the deepest pockets always win—has been dismantled by a new reality: speed often kills scale. While legacy organizations struggle with the inertia of their own success, agile challengers are exploiting the gaps left by bureaucratic decision-making.

However, growth brings its own paradox. The very agility that allows a startup to disrupt a giant often evaporates as the startup scales. Conversely, large organizations possess the data and resources to dominate but frequently fail to execute due to fear of reputational risk and internal silos.

This article deconstructs the core mechanics of sustainable growth. We will explore why “playing it safe” is a losing strategy, how to identify profitable niches based on human behavior, and why your brand’s trust has invisible boundaries you must not cross.

The Asymmetric Advantage: Speed vs. Reputation

The Burden of the Giant

Large organizations operate under a heavy constraint: reputational risk. For a market leader, trust is an asset won or lost every 24 hours. This fear of public failure often paralyzes decision-making, leading to “blocking and tackling” behaviors where power is derived from rejecting proposals rather than approving them. Consequently, innovation in legacy companies is often stifled not by a lack of ideas, but by a rational over-analysis of risk and personal biases in the boardroom.

The Weapon of the Challenger

For smaller entities, speed is the ultimate competitive advantage. A startup can conceptualize and execute a go-to-market strategy in months, whereas a giant might take a year just to approve the concept. During that year of deliberation, the agile player can iterate five times.

Key Insight: Capital cannot beat non-capital if the execution is flawed. While large companies have access to infinite resources, they often lack the “speed of thought” required to deploy them effectively.

The Power of Niches: Time, Health, and Ego

Attempting to be everything to everyone is a guaranteed path to mediocrity. A critical error in scaling is spreading resources across multiple categories that achieve marginal growth (“jumping two feet”) rather than focusing on one category to achieve exponential dominance (“jumping ten feet”).

To identify a high-growth niche, look for three specific dimensions:

- The Dimension of Time

Modern consumers are time-poor. Any business model that saves time or utilizes “dead time” (such as the night economy or commute times) has immense potential. The shift from cooking raw ingredients to ready-to-cook solutions is not just about food; it is about buying back an hour of freedom. - The Dimension of Health and Vitality

Wellness is no longer a luxury; it is a primary driver. Products focusing on fitness, appearance, and longevity are seeing explosive demand. This includes not just nutrition, but the infrastructure of health, such as 24/7 fitness access. - The “Unique Show-Off Proposition”

In status-driven markets, consumers do not just buy utility; they buy social currency. A product must offer a “Unique Show-Off Proposition”. Whether it is a luxury travel destination or a branded shirt, the item must signal status to the buyer’s peer group. If a product cannot be “shown off” (digitally or physically), its premium pricing power is severely limited.

Brand Elasticity: Knowing When to Stop

One of the most dangerous traps for a growing business is the seduction of brand extension. Companies often assume that high consumer trust in one category automatically transfers to another. This is false.

The Sensory Mismatch

Trust is often category-specific. A brand known for fragrance and beauty may fail spectacularly if it attempts to enter the oral care market. Why? Because the consumer association with “perfume” clashes with the sensory expectation of “taste” required for toothpaste.

The Value-Trust Equation

If a brand is trusted for making great tea, consumers might trust them to make biscuits (a complementary behavior). However, if they are trusted for making soap, they likely won’t be trusted to make tea. Strategic expansion requires understanding the “core” of the brand—is it based on taste, smell, security, or durability? Crossing these invisible sensory lines leads to market rejection.

Leadership and Culture in a Digital Age

The Feedback Revolution

Traditional hierarchies function on “high power distance,” where subordinates validate the leader’s ego rather than the business reality. Leaders in this mold often ask for feedback but only truly desire validation.

However, the younger workforce—raised in the era of social media—operates differently. They are accustomed to instant metrics (likes/comments) and demand real-time feedback. They do not respect hierarchy for its own sake; they respect engagement. A leader who remains silent or distant is viewed as disconnected, and silence is often interpreted worse than criticism.

Hiring for the Next Level

Founders often struggle to scale because they hire for where the company is, not where it is going.

- The Rule of Scale: To grow from $10 million to $50 million, you must hire leaders who have already managed $50 million portfolios.

- The Comfort Paradox: Founders must hire executives they are personally comfortable with, yet who possess the discipline and structural thinking the founder lacks.

- Variable over Fixed: When scaling, smart companies keep costs variable (talent, R&D) rather than sinking capital into heavy fixed assets that drag down agility.

Practical Strategies for Strategic Growth

- The “Zero-Based” Innovation Audit

Do not rely on legacy success. Ask: If we launched today with zero history, would we design this product this way? Legacy companies often fail because they are “rational” to a fault, killing ideas based on personal biases or risk aversion. To counter this, suspend judgment in meetings. Let the team debate the “why not” before the leader speaks, preventing the “Hippo effect” (Highest Paid Person’s Opinion) from silencing dissent. - Tailor Value Propositions to Cultural Archetypes: Understanding global customer psychology is vital:

- Value Seekers: Some markets (like India) demand extreme value. They will haggle for a discount on luxury items solely for the psychological win of the “deal”.

- Innovation Seekers: Markets like China demand a dual-threat: high innovation and low price.

- Return-Oriented: Markets like the US prioritize service guarantees and return policies over pure price.

- Digitization as a Business Model, Not a Channel: Many legacy firms view “digital” merely as marketing. True digitization means restructuring the business model. Banking sectors that replaced physical branches with digital infrastructure outpaced FMCG giants that merely tweaked their advertising. If your digital strategy doesn’t reduce your fixed costs or alter your delivery mechanism, it is superficial.

Common Mistakes & Challenges

- Playing for a Draw: Leaders who are afraid to lose often “play for a draw” rather than playing to win. This defensive mindset guarantees stagnation.

- The “Silo” Trap: As companies grow, departments (Sales vs. Marketing vs. Finance) begin fighting each other rather than the competition. Power shifts to those who block initiatives rather than those who drive them.

- Ignoring the “Security” Driver: For lower-income demographics, brands represent security, not vanity. They buy established brands because they cannot afford the risk of a product failure. Ignoring the need for robust service networks in rural or lower-income markets is a fatal error.

Actionable Checklist for Decision Makers

The Niche Test:

Is your new product saving time, improving health, or offering a “show-off” benefit? If not, reconsider the launch.

The Cost Audit:

Are you increasing fixed costs or variable costs? Prioritize variable costs to maintain agility.

The Meeting Protocol:

In strategy meetings, does the leader speak first or last? Ensure the leader speaks last to encourage diverse viewpoints.

The Succession Plan:

Are you grooming the layer below you? A Board’s primary duty is ensuring the company survives the current CEO.

The Feedback Loop:

Implement systems for rapid, candid feedback. If your team isn’t criticizing you, they are likely disengaged.

FAQs

Q: Can a small company really beat a large conglomerate with deep pockets?

A: Yes. History shows that big companies rarely beat small, fast companies. Slow companies are beaten by fast companies. Large organizations are often hindered by internal bureaucracy and risk aversion, allowing agile startups to exploit niches and execute faster.

Q: How do we know if a brand extension will fail?

A: Analyze the core association of your brand. If the extension requires a sensory shift (e.g., from fragrance to taste) or a capability shift that contradicts your established trust (e.g., a luxury brand making budget tools), it will likely fail. Trust is not universally transferable.

Q: What is the biggest risk for a founder stepping back?

A: The biggest risk is hiring a professional CEO without establishing personal chemistry and shared values. Without this alignment, the culture clashes, and the company loses its entrepreneurial soul. However, staying too long without professionalizing structures is equally dangerous.

Conclusion

Building a lasting enterprise requires navigating a delicate tension. You must be small enough to care about speed but structured enough to handle scale. You must be innovative enough to take risks but disciplined enough to respect the invisible boundaries of your brand’s trust.

The market rewards those who offer genuine value—whether that value is measured in money saved, health gained, or status signaled. It punishes those who rely on legacy, ignore the changing feedback loops of the workforce, or play merely to avoid losing.

Ready to audit your growth strategy? Start by evaluating your “Speed of Thought” vs. your “Weight of Capital.” The future belongs to the fast.